Author: Benedetta Lupo

By Stefano Loconte, Angela Cordasco e Beatrice Molteni

Stefano Loconte, Angela Cordasco and Beatrice Molteni from Loconte&Partners authored the Italian chapter of the very prestigious Chambers Private Wealth 2020 Guide. ⠀

The contribution covers many interesting topics related to the Private Wealth area, such as the new attractive tax regimes, the trust regulation in Italy, estate law and family business planning.⠀

Once again, Loconte&Partners wealth management team’s has been chosen for its expertise in assisting HNWI.⠀

Read and download the full issue here (Download)

By Stefano Loconte

Read the contribution of our founder Stefano Loconte, published in Islamic Finance news Volume 17 Issue 33 dated the 19th August 2020, about the new sustainable and environmentally friendly investments (ESG) Italian Baks are rapidly embracing.

“Environmental, social and governance (ESG) factors are rapidly arising in investors’ awareness worldwide and expected to grow in the Islamic finance industry due to a strong link between the two.

Such sustainable notions also exist in Islamic finance and the size is reportedly substantial. For example, Waqf, which is a donation of an asset or cash for religious or charitable purposes with no intention of reclaim, is construed as a type of socially responsible financing. Therefore, it is possible to imagine the thin alignment between the Islamic finance industry and these sustainable factors

Sustainability, equality and a clean environmental record are the essential factors of financial performance and savvy investors are starting to embrace them.

In such a scenario, sustainable investment funds are confirming their efficiency in managing underlying risks and delivering more resilient returns because they support and finance companies that are preserving the wellbeing of the planet and the community.”

Read the full Issue at this link

or download the PDF version here (Download)

By Stefano Loconte

Our Managing Partner has analysed special requirements to establish an Islamic bank in Italy on this article which was first published in Islamic Finance news Volume 17 Issue 30 dated the 29th July 2020

“The possibility of opening an Islamic bank in Italy can be a reality but it requires respecting binding rules and specific procedures.

In fact, institutions that could offer Shariah compliant financial products and services could collaborate with Islamic banks or branches of an Islamic bank established in another European or extra-EU country. In any case, each type of Islamic financial institution needs a Shariah board, or Shariah supervisory board (SSB), that sits at the top of the company’s governing structure”

Read the full article here online on IFN News

Otherwise you can download a PDF of the single page with the article, here as follow (Download)

By Stefano Loconte for IFN Islamic Finance News Volume 17 Issue 26 (1st July 2020)

“It is remarkable that the Italian legal framework does not forbid but at the same time does not even expressly authorize these operations. The main reason why these operations are not performed in Italy is due to the fiscal costs. In fact, these financial operations are subject to double taxation compared to the traditional ones. The costs incurred will not be, economically speaking, sustainable for the banks. At this point, it seems necessary for the introduction of a specific framework to balance the Islamic finance model with the traditional models, in line with what has has already been done in other European member states”

Read the full contribution of our founder Stefano Loconte, published in Islamic Finance news Volume 17 Issue 26 dated the 1st July 2020, about the possibility and the difficulties of creating the “Islamic windows” in Italy.

”

You can also download the single PDF page at this link (Download)

Loconte&Partners Art advisory is pleased to have hosted our Webinar WEALTH&ART ON WEB on June 23th at 5.30 CEST, when we had a special guest, Marine Tanguy, founder of the international certified B Corp® and award-winning artists’ agency MTart-agency.

Their motto “Don’t invest in art, invest in artists”, drives an unique approach to art investing, aiming to provide their artists with a solid career.

In just few years they already have a substantial track of accomplishments, press reviews and projects all over the world and in 2018 Marine was recipient of Forbes 30 under 30 Europe: Art and Culture. Together we will discuss the role of the different art players, relationships and strategies to create value behind the artist, as well as the importance of collaborating with brands and cities, exploring new ways of building a successful career for visual artists.

Panel speakers: Elisa Carollo e Massimiliana Palumbo from Loconte&Partners Art Advisory in conversation with Marine Taguy Founder and CEO of MTart-agency

Free Webinar – 45min – English only

RSVP

We are pleased to announce our next Webinar WEALTH&ART ON WEB on June 23th at 5.30 pm CEST, when we will have a conversation with Marine Tanguy.

Marine founded in 2015 MTArt Agency, a certified B Corp® award-winning agency for the most exciting up and coming visual artists worldwide.

The art industry typically concentrates on selling art on walls, MTArt focuses on investing and supporting the person behind it.

Their motto is: “Don’t invest in art, invest in artists”, driving a unique approach to art investing, aiming to provide their artists with a solid career.

Every month, the agency reviews 200 portfolios of artists. Its selection committee chooses artists with innovative techniques, inspiring content and strong messaging. For the artists who sign with the agency, MTArt covers their studio costs, sells their works, implements cultural & commercial partnerships and offers press exposure. This is how they accelerate their artistic reputation, visibility and success. MTArt measures their successes from the number of sales, PR coverage, economic growth to credibility building.

In just a few years MTArt Agency has a substantial track record of accomplishments, press reviews and projects all over the world and in 2019 and 2020 their artists Saype and Obvious were recipients of Forbes 30 under 30 Europe: Art and Culture.

Together we will discuss the role of the different art players, relationships and strategies to create value behind the artist, as well as the importance of collaborating with brands and cities, exploring new ways of building a successful career for visual artists.

By Elisa Carollo

ARE YOU READY FOR ART BASEL (ONLINE)?

In this article by our Art Advisor Elisa Carollo on ART SHE SAYS a short overview and a selection in “pink” from the preview days, to help you navigate the + 4.000 works and 282 galleries included in this year art fair online.

Enjoy!

“After its postponement, we were waiting for Art Basel in IRL (in real life) in September, and all top collectors and dealers had already booked their usual room at the Le Trois Rois.

However, between podcasts and webinars where the art world discussed if and how it will survive and whether collectors are now familiar with buying online, eventually Art Basel was forced to cancel this year’s edition and postpone its 50-years celebration hopefully under Miami palms, once these “challenging times” are over.

So Art Basel (Basel) opened once again only as a virtual fair, starting yesterday with 2 days of VIP previews preceded by a “virtual welcome reception” on Zoom with the directors Marc Spiegler, Noah Horowitz and Adeline Ooi.

No champagne, physical human contact, or networking, but the art fair added new features on its platform, making it much easier to navigate, including interactive content such as videos of art or artists explaining their works, providing framework to the 4000+ artworks to browse through, otherwise art dealers and collectors would be at an endless scroll.

Still, as the director Marc Spiegler said to the Financial Times, this “Amazon art world sounds more like hell than heaven. It is a world with no power to move our souls,” and he hopes to come back soon in welcoming physical visitors to the

You can read the full article at this LINK

A successful webinar took place yesterday with GGI TEP PG’s members.

Our Angela Cordasco and Beatrice Molteni organized and participated as speakers to the GGi Trust and Estate Planning Practice Group webinar.

It was a great occasion to discuss many topics related to the use of Italian companies for wealth planning, the use of US LLC’s in foreign trust structures and also about the compliance obligations in case of death of the settlor or of the beneficial owner of the trust.

We thank the other speakers Darlene Hart and Robert Anthony, the GGI organization and all the attendees for their participation, it was good to see all of you again!

LOCONTE& PARTNERS FOR IFN ISLAMIC FINANCE NEWS

Read the contribution of our founder Stefano Loconte, published in Islamic Finance news Volume 17 Issue 18 dated the 6th May 2020, about the set of rules that oversee the issuance of Islamic financial products in Italy.

“The possible offer of Islamic financial products, both by Italian institutions and Islamic windows in Italy, is a real perspective that has to be taken into consideration in order to expand the chances for Italy to gain new investments and grant investors the diversification of their investments.”

As Alternative, you can download the single page here.

LOCONTE&PARTNERS is pleased to announce the show Legacy by the artist Riccardo Beretta, and organised in collaboration with the galley Francesca Minini and with the technical support of Art Defender Insurance.

Origianlly planned for as a physical event in our Milan office, the COVID-19 emergency urged us to find an alternative, so we decided to present our project as Instagram Show (for now)

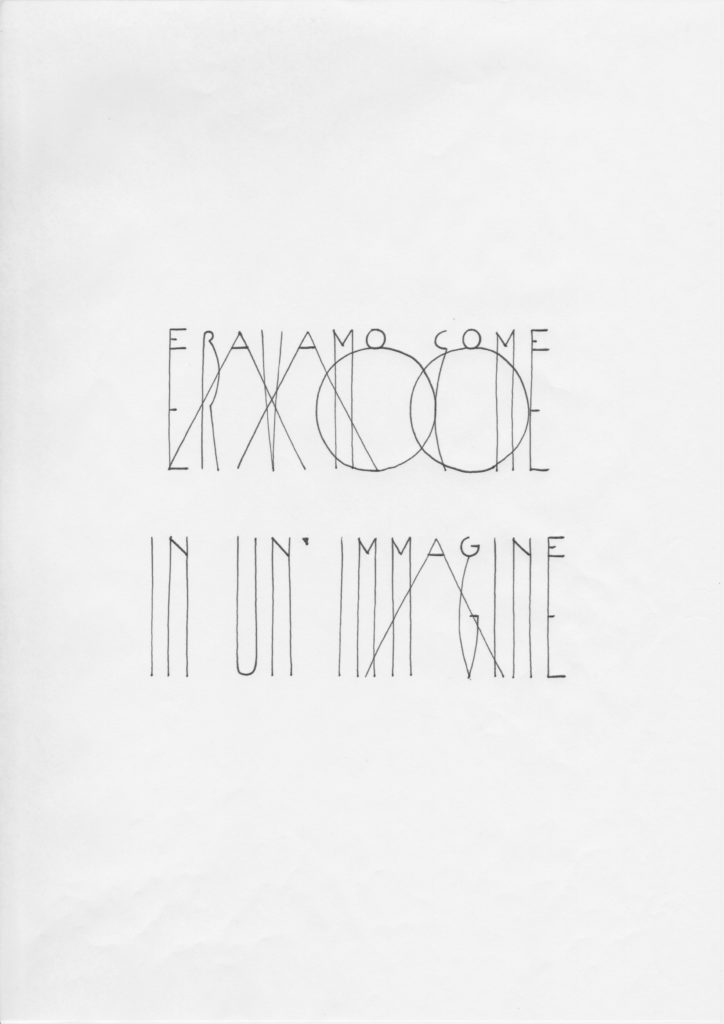

In conjunction with the show also a charity campaign: the artist with our support of decided to realize a series of new drawings unique pieces for sale to support the “Guglielmo da Saliceto” Hospital in Piacenza.

All the drawings are at 200 minimum price, and will be presented everyday in our stories starting from April 14 on our instagram profile @loconteandpartners

Each work on paper has been specifically created as response to the difficult moment we are living: inspired by the verses of G.Bachelard “Terre et les rêveries du repos”, each drawing was realized with the artist original Fontaine font (2009), and specifically selected to create visions of relief or considerations, for everyone who will welcome them emotionally, as well as physically in acquiring it.

As Follow, a PDF version of the catalogue (in Italian)

By Stefano Loconte

Our contribution on the latest Islamic Finance News 1st April 2020 (Volume 17 Issue 13, page 15)

“If we want to consider the opportunity for Italy to create an Islamic Bank, namely the possibility to constitute an Islamic bank, an Italian subsidiary of an Islamic bank or an Islamic window of an Italian bank, we firstly have to consider that the concept of ‘bank’ as designed in conventional Finance does not exist in Islamic finance. What is different is the business object of the institution and the manner it is pursued. An Italian bank usually collects deposits and grants credits and, pursuant to Article 10 of the Italian Consolidate Law on Banking, ‘banks’ are institutions which can exercise, not only banking activities, but also all those financial activities not reserved by the law to other specific intermediaries.In view of this, it is important to take into consideration the special features that an Islamic financial institution need to be Shariah compliant, but also to verify the rules a bank in Italy shall comply with to play its activities”

This article was first published in Islamic Finance news Volume 17 Issue 13 dated the 1st April 2020.

Read the full article on the latest IFN p.15: you can download the full 1st April issue as PDF online at www.islamicfinancenews.com, read the single article online here, or download as a PDF here below.

By Stefano Loconte e Angela Cordasco

The GGI Trust&Estate Planning Spring Newsletter is now online, with the editorial of our Managing Partner, Stefano Loconte, as the Global Chairperson of the GGI Trust&Estate Practice Group.

Our senior associate Angela Cordasco authored an article on the taxation of distribution from opaque foreign trusts sets up in Blacklist Countries.

The GGI TEP Spring Newsletter offers numerous contributions on specific topics written by GGI members from all over the world.

A great opportunity to share the latest updates and developments on the trust and estate planning sector!